One of the questions I am often asked these days is how the stock market can keep rising in the face of a disastrous economic situation, with many companies going out of business and millions of people losing their jobs. There is no doubt that social distancing measures and shutdowns have wreaked havoc on the economy, however, what is lost in the extreme narrative is an understanding of how the stock market works and the best strategy to profit from it.

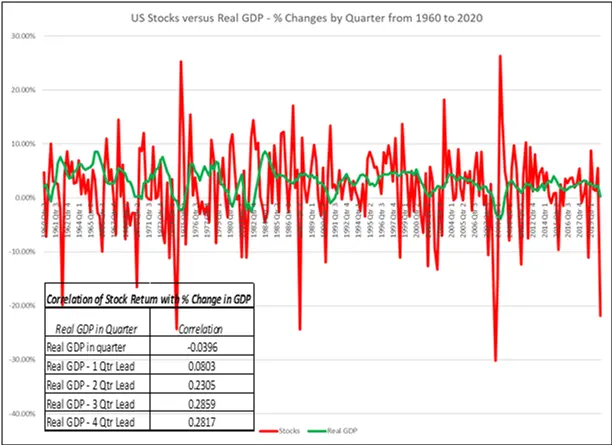

At a fundamental level, stock prices are based on a discounting mechanism and the price you pay for stocks today is the present value of future corporate earnings. This means stock markets are forward looking and they rise or fall based on anticipated future earnings. On the other hand, the news about the economy that we read in the press are backward looking relaying information from the past. For those of you that prefer numbers, you can see in Figure 1, the correlation between stock performance and the percentage change in GDP (Gross Domestic Product, i.e. the output of the economy) is very weak coincidentally, but improves if you consider the rate of change in GDP with a lag. When the stock market rises it is reflecting an expected improvement in the economy (And corporate earnings) in the future. Sometimes the stock market predicts the economy correctly- we got a sample of that last Friday, when the employment numbers surprised to the upside proving every wall street economist wrong.

Figure 1. Correlation between stock returns and the Gross Domestic Product (The economy)

Source: Prof Aswath Damodaran, NYU

Secondly, the mathematics of discounting is such that when interest rates are low, the present value of future earnings increases, thus supporting higher stock prices. Currently, interest rates are at a historically low level thanks to the easy monetary policy of the Federal Reserve.

Thirdly, corporate earnings can continue to grow even when the economy is stagnant, as we saw over the last few years. Companies have several levers such as refinancing debt, inorganic growth, accessing overseas markets and stock buybacks by which to increase income even in a low or no growth domestic economy.

Finally, stock prices reflect future earnings over several years. A few quarters of subpar or falling corporate earnings has a minimal impact on the present value. If earnings are expected to bounce back after a few quarters then the stock markets would ignore the drop in earnings in the near future.

All this does not mean that the stock markets are never wrong. Stock markets often overshoot both on the way up and down. However, over the long run, stocks produce returns over inflation and the best way to capitalize on that is to build diversified portfolios that work well over the long term. Investors that try to time the market and make investment decisions based solely on their understanding of the economy, hurt themselves financially in the long run.